EV maker Rivian (RIVN) launched its third-quarter monetary earnings Thursday after the market closed. With fewer deliveries within the quarter, Rivian’s income missed expectations. Nevertheless, the EV maker guarantees issues are wanting up from right here. Right here’s a breakdown of Rivian’s Q3 2024 monetary earnings

Earnings preview

Yesterday, Electrek posted a preview of what to look out for in Rivian’s third-quarter earnings. One of many greatest issues buyers will likely be watching is Rivian’s high line.

After a provide scarcity brought on Rivian to decrease its manufacturing objective for 2024, the corporate now expects to construct between 47,000 and 49,000 autos this 12 months, down from the earlier 57,000 goal.

With one other 13,157 EVs constructed final quarter, Rivian’s manufacturing complete reached 36,749 by September. To hit its goal, Rivian might want to construct one other 10,251 to 12,251 autos in This autumn.

Regardless of this, Rivian nonetheless expects slight supply development over final 12 months, with between 50,500 and 52,000 items delivered in 2024, up from 50,122 in 2023.

In response to Estimize, Rivian is predicted to report a lack of $0.96 per share in Q3 2024, an enchancment from the 1.19 loss per share final 12 months. Rivian is predicted to report income of round $1 billion, which might be a 25% drop from the $1.34 billion generated in Q3 2023.

Rivian Q3 2024 earnings breakdown

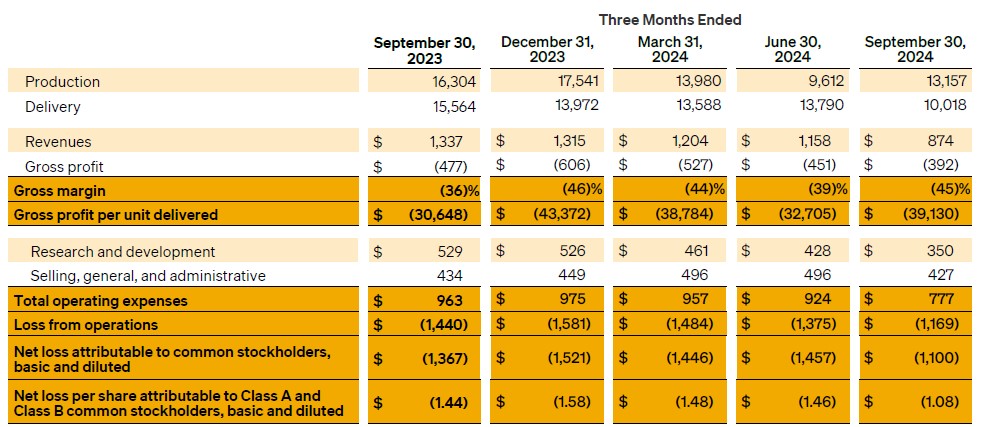

Rivian reported third-quarter income of $874 million, an almost 35% drop from Q3 2023 and lacking expectations.

The corporate stated larger electrical supply van (EDV) deliveries for Amazon final 12 months was partly the explanation for the decrease top-line complete.

Rivian posted a gross revenue lack of $392 million, down from the $477 million loss final 12 months as a result of decrease supply complete. In the meantime, working losses additionally fell to $1.17 billion, down from $1.44 billion in Q3 2023.

The corporate misplaced $39,130 on each car delivered in Q3 2024, which is up from $30,648 final 12 months and $32,705 in Q2 2024.

| Q3 ’22 | This autumn ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This autumn ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | |

| Rivian loss per car | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 | $39,130 |

Rivian’s internet loss within the third quarter was $1.1 billion, down from $1.34 billion final 12 months with a $1.08 loss per share.

The EV maker confirmed it’s nonetheless on observe for a optimistic gross revenue within the fourth quarter of 2024. Rivian’s CEO, RJ Scaringe, stated the corporate is seeing “significant progress” on its materials prices with new tech and manufacturing processes.

| Q1 2024 | Q2 2024 | Q3 2024 | 2024 YTD | 2024 steering | |

| Deliveries | 13,588 | 13,790 | 10,018 | 37,396 | 50,500 – 52,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 36,749 | 47,000 – 49,000 |

These enhancements are significant steps towards its next-gen R2, which can launch within the first half of 2026.

Scaringe stated Rivian believes R2 will likely be a “basic driver of Rivian’s development.” It’s going to begin at $45,000, practically half the price of its present R1S and R1T fashions.

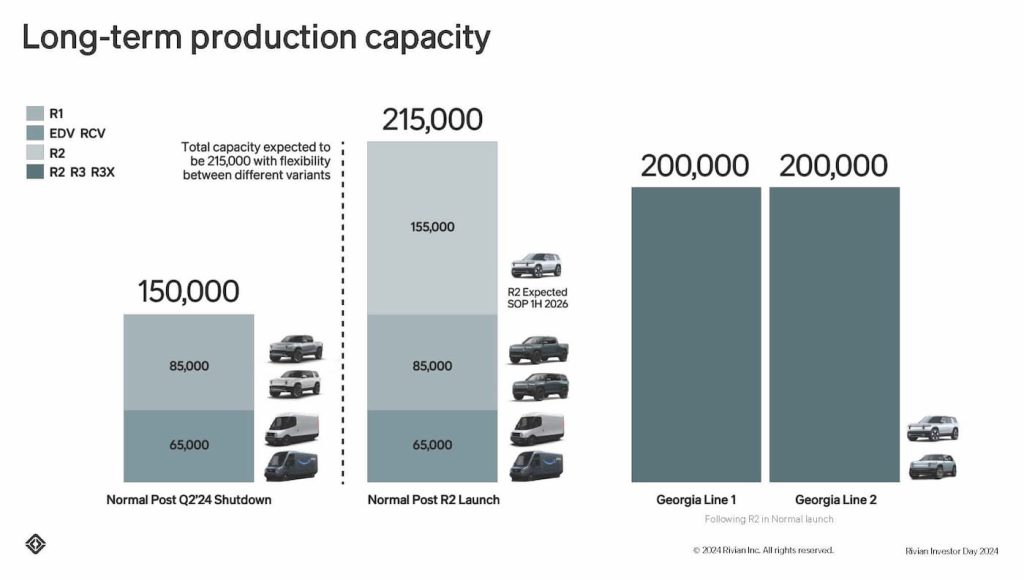

As soon as R2 manufacturing begins, Rivian expects the brand new EV will account for many of its output. The corporate plans to construct 155,000 R2 fashions yearly and about 85,000 R1S and R1Ts in Regular.

Rivian additionally believes its new alliance with Volkswagen will likely be “a landmark growth for the trade.” The whole deal dimension is as much as $5 billion, which Rivian stated is a “significant monetary alternative.”

The deliberate investments along with Rivian’s present money and equivalents “are anticipated to supply the capital to fund Rivian’s operations by the ramp of R2 in Regular, in addition to the midsize platform in Georgia,” the corporate stated. This may set up a path to optimistic free money circulate and significant scale.

The corporate ended the quarter with $6.7 billion in money and equivalents, together with a $1 billion convertible observe from Volkswagen. Rivian reaffirmed its (revised) manufacturing and supply targets for 2024.

Because of the decrease manufacturing outlook, Rivian now expects an EBITDA lack of $2.83 billion to $2.88 billion, in comparison with the earlier steering of a $2.7 billion loss.

Examine again for extra following Rivian’s earnings name with buyers. We are going to put up updates under.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.