EV startup Lucid Motors (LCID) launched its fourth-quarter earnings on Tuesday, beating estimates with huge expectations for 2025. Lucid stated it expects to provide about 20,000 EVs this 12 months with the output of its first electrical SUV, the Gravity, ramping up.

This autumn 2024 earnings preview

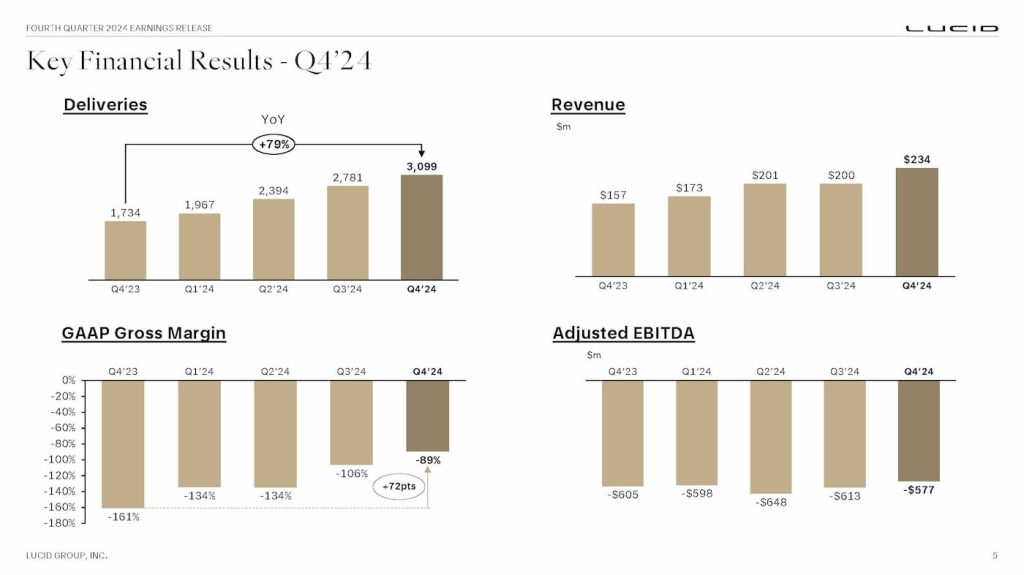

After 4 straight file quarters, Lucid delivered 10,241 automobiles final 12 months. That’s up 70% from the roughly 6,000 EVs Lucid delivered in 2023.

Within the closing three months of 2024, the corporate delivered 3,099 automobiles alone, practically 80% greater than the 12 months prior. Lucid additionally hit its manufacturing goal for the 12 months with 9,029 EVs constructed at its Casa Grande, Arizona manufacturing plant.

After launching its first electrical SUV, the Gravity, in December, the EV maker expects output to select up this 12 months.

The upper quantity helped Lucid generate $200 million in income within the third quarter, however its web loss additionally widened to $992.5 million in comparison with $630.9 million in Q3 2023.

Like most, Lucid has launched important reductions and incentives with as much as $15,000 in financial savings on choose Air fashions.

| This autumn 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Full-year 2023 | This autumn 2023 | Q1 2024 | Q2 2024 | Q3 2024 | This autumn 2024 | Full-year 2024 | |

| Lucid EV deliveries by quarter | 1,932 | 1,406 | 1,404 | 1,457 | 6,001 | 1,734 | 1,967 | 2,394 | 2,781 | 3,099 | 10,241 |

Wall St is estimating Lucid will submit This autumn income of $214 million, up from $157.2 million in This autumn 2023, with an eps lack of 0.25.

Lucid goals to double EV manufacturing in 2025

Lucid reported This autumn income of $234.5 million, up practically 50% from the prior 12 months and beating Wall St estimates. For the complete 12 months, the corporate generated $807.8 million, up from $595.2 million in 2023.

- Lucid This autumn 2024 income: $234.5 million vs $214 million anticipated

- Lucid This autumn 2024 EPS: (-$0.22) vs (-$0.25) anticipated

The corporate additionally improved gross margins by 72pts to (-89%). Regardless of the upper output, Lucid’s working loss narrowed to $732.95 million in This autumn, down from $736.87 million a 12 months prior.

Lucid ended the quarter with about $6.13 billion in liquidity, which the EV maker stated will probably be adequate into the second half of 2026 when it plans to launch its midsize platform.

CEO Peter Rawlinson stated earlier this month that the midsize platform is “lastly once we compete straight with Tesla.” The primary two fashions are anticipated to be an electrical SUV and sedan beginning at round $50,000, aimed toward Tesla’s Mannequin 3 and Mannequin Y.

Interim CFO Gagan Dhingra stated, “We made substantial progress in enhancing our gross margins, managing our working bills whereas balancing strategic development investments, and strengthening our stability sheet with the help of the Public Funding Fund (PIF).”

Lucid expects to provide round 20,000 automobiles in 2025, greater than double the simply over 9,000 EVs it constructed final 12 months.

The corporate stated it should “proceed to prudently handle and alter manufacturing to satisfy gross sales and supply wants” this 12 months.

Lucid’s upbeat steering comes after Rivian (RIVN) introduced throughout its This autumn earnings final week that it anticipated barely fewer deliveries this 12 months. Rivian stated the decrease steering was as a result of “exterior elements,” together with modifications in authorities insurance policies and laws.

The corporate additionally introduced a number of administration modifications. COO Mark Winterhoff will function interim CEO, whereas Peter Rawlinson will change into a Strategic Technical Advisor on the board. In the meantime, Taoufiq Boussaid has been appointed CFO.

Lucid’s inventory climbed over 8% after beating fourth quarter estimates and elevating EV output steering for 2025. Examine again for updates from Lucid’s earnings name. We’ll submit updates from the decision under.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.