Roughly 1 / 4 of Tesla’s earnings final quarter had been resulting from recognizing a $600 million achieve on Bitcoin. Tesla nonetheless got here in need of expectations.

Tesla and Bitcoin

Tesla is among the many few massive public corporations that invested a few of their money into cryptocurrency.

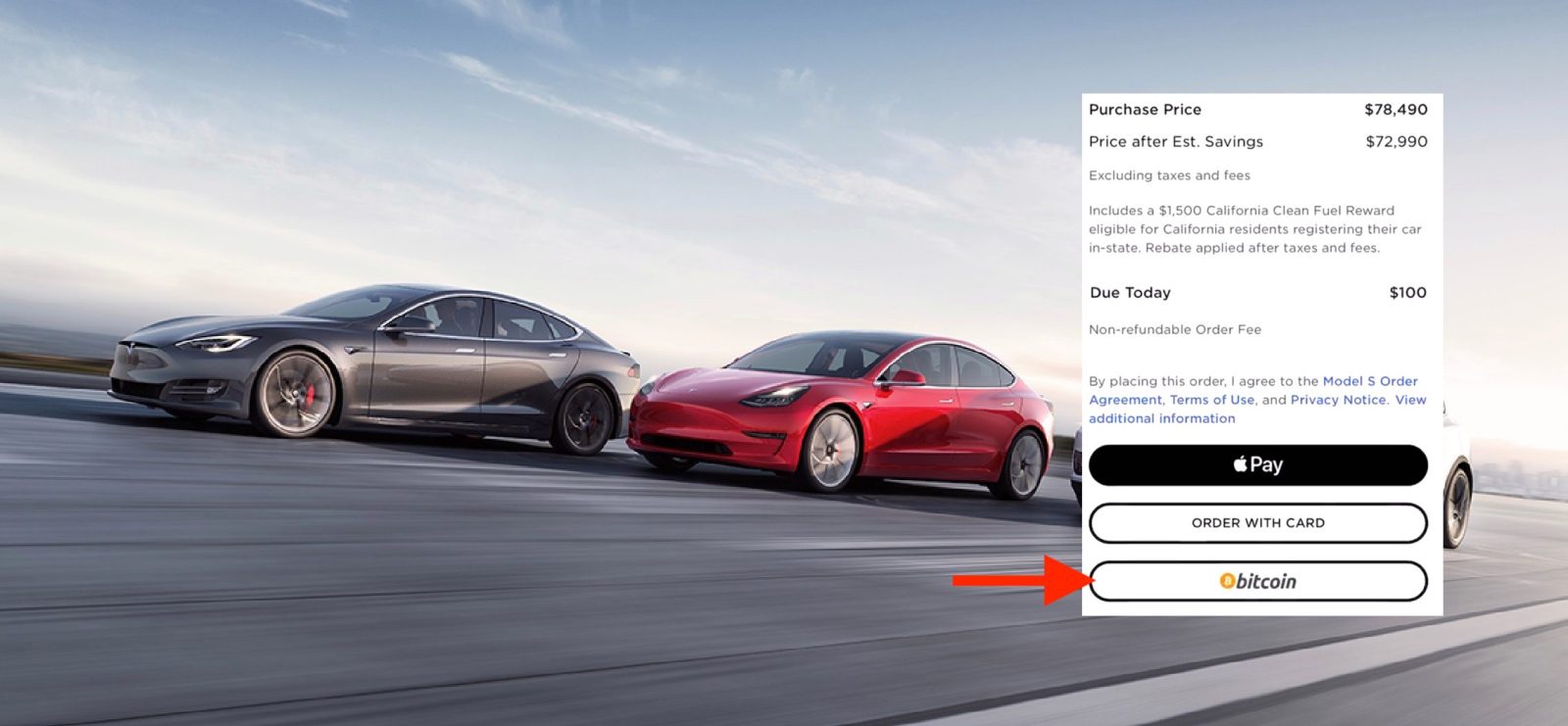

Early in 2021, Tesla invested $1.5 billion in Bitcoin. Shortly after, the automaker began accepting the cryptocurrency as fee on new autos.

Nevertheless, just a few days later, Tesla took a step again with crypto by eradicating the Bitcoin fee choice. The corporate famous issues over the power wants of the Bitcoin community:

Tesla has suspended car purchases utilizing Bitcoin. We’re involved about quickly growing use of fossil fuels for Bitcoin mining and transactions, particularly coal, which has the worst emissions of any gas.

It is a concern that many Tesla group members shared when Tesla first introduced its Bitcoin funding, and plenty of had been angered by the truth that the corporate didn’t give it some thought within the first place.

On the time, Tesla famous that they weren’t promoting their stake in Bitcoin and that they deliberate to renew taking Bitcoin funds as soon as the community confirmed a better mixture of renewable power.

Final 12 months, Tesla made some strikes that pointed to beginning to take Bitcoin funds once more, however it has but to occur.

A 12 months after the preliminary funding, Tesla’s Bitcoin holding elevated to $2 billion, however the cryptocurrency misplaced a whole lot of its worth in 2022 and the automaker’s place suffered – although the automaker additionally divested about 75% of its Bitcoin place throughout that point.

Tesla reported over $1.2 billion in proceeds from promoting Bitcoins, however the automaker nonetheless sits on a superb quantity.

Tesla’s Bitcoin transfer in This autumn 2024

Final quarter, Tesla moved its bitcoins round into new wallets, triggering a whole lot of speculation. We suspected that Tesla is perhaps shifting issues round to adjust to the most recent crypto accounting laws.

Positive sufficient, with the discharge of Tesla’s This autumn 2024 earnings yesterday, the automaker confirmed that it moved the Bitcoin to adjust to the adoption of ASU 2023-08.

The transfer enabled Tesla to report a $600 million mark-to-market achieve, accounting for a big a part of its $2.3 billion web revenue in This autumn, which was already down 70% year-over-year.

Tesla disclosed in a SEC submitting at this time:

Different revenue (expense), web, modified favorably by $523 million within the 12 months ended December 31, 2024 as in comparison with the 12 months ended December 31, 2023 primarily resulting from remeasurement of our bitcoin digital property to truthful worth in 2024 (see above), partially offset by unfavorable fluctuations in international forex alternate charges on our intercompany balances.

If it wasn’t for Bitcoin, Tesla’s web revenue could be down 78% in This autumn 2024 in comparison with This autumn 2023.

In case you take away regulatory credit score, it might be down 86% and Tesla’s earnings would add as much as barely greater than $1 billion in comparison with its greater than $1 trillion valuation.

Electrek’s Take

Bitcoin actually saved Tesla’s quarter. Except there’s one other main run-up in Bitcoin, that gained’t occur once more as a result of Tesla has benefited from not measuring Bitcoin’s worth for greater than a 12 months.

It was nice timing for Tesla, however it gained’t be capable to save the corporate in Q1 2025, which is predicted to be more difficult because it transitions its Mannequin Y to the brand new model.

However based mostly on the inventory value at this time, it seems that Elon nonetheless has sturdy shareholders assist as they nonetheless consider in his AI-related predictions.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.